Choosing the right accountant: Tips from Inc. Magazine

It's hard to find a good accountant—so hard, in fact, that it has become something of a running joke in the small business world...

Most things that a business does have tax implications.

Most things that a business does have tax implications.

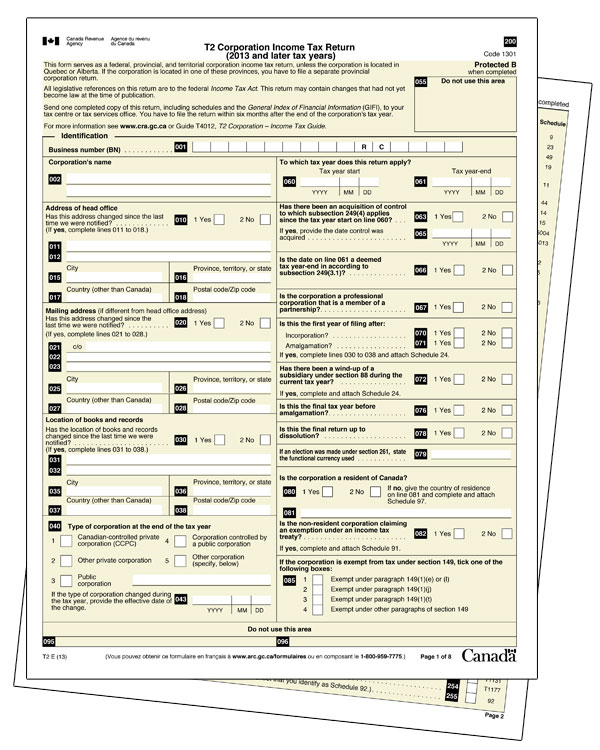

Our tax professionals are experienced in all areas of corporate taxation and can help with your tax planning from the initial start-up of your business through to your retirement and the sale or transfer of your business.

First, we schedule a conversation with you, so we can understand your business.

Then, we provide an overview of what will be required at year end, to complete your corporate taxes.

When the time comes, you simply provide access to your records and we take care of the rest. Your corporate tax return will be completed professionally, accurately, and with an eye to maximizing any available benefits.

In addition to handling the nuts and bolts of your corporate tax, we prepare “Notice to Reader” Financial Statements to assist you in making business decisions, present to financiers, and use as a basis for your corporate tax return that complies with tax laws that we Efile on time.

It's hard to find a good accountant—so hard, in fact, that it has become something of a running joke in the small business world...

Succession planning can be one of the most difficult and challenging tasks for a small business owner. Why? For some business owners, it's a matter of...